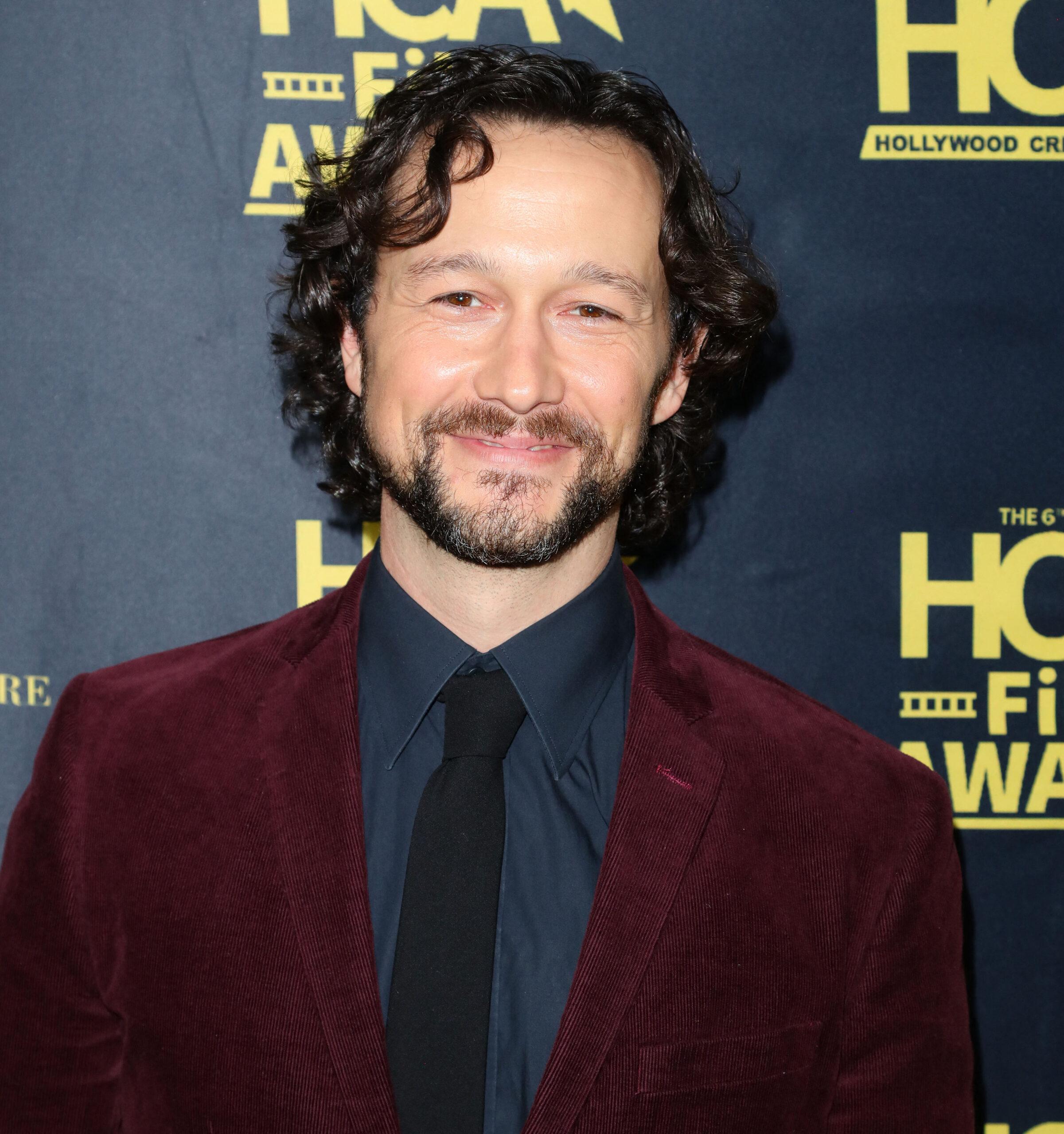

'Don Jon' Star Joseph Gordon-Levitt Criticizes Donald Trump's $70K Tax Break Plan

By Kelly Coffey-Behrens on August 31, 2024 at 9:30 AM EDT

In a brief video shared on Friday, actor Joseph Gordon-Levitt—an accomplished two-time Emmy Award winner and member of the top 1% of earners—details his opinion of the proposed $70,000 tax break that former President Donald Trump aims to provide to wealthy individuals, like himself.

Trump plans to extend the tax cuts established by the Tax Cuts and Jobs Act, his notable 2017 legislation that lowered taxes for most Americans, but primarily benefited the highest earners. Additionally, he proposes eliminating taxes on tips and Social Security income and reducing the corporate tax rate.

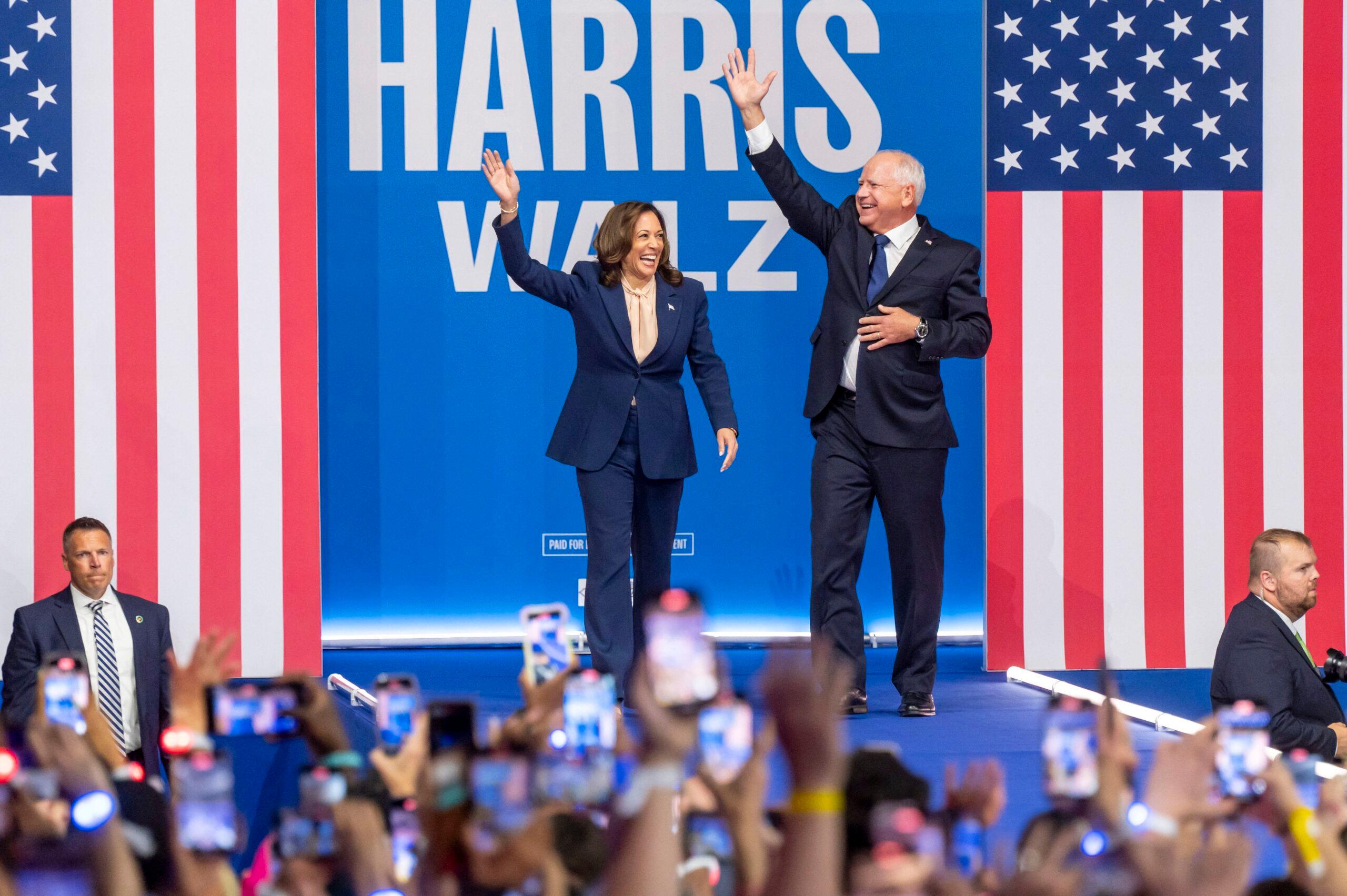

Vice President Kamala Harris, on the other hand, has proposed offering more substantial tax benefits for families and increasing the corporate tax rate to help balance the costs of expanded tax credits.

As the 2024 Presidential Election approaches, "Don Jon" actor Joseph Gordon-Levitt is speaking out.

Joseph Gordon-Levitt Talks Donald Trump And Kamala Harris

In a nearly minute-and-a-half video shared to his X account, the social media platform formerly known as Twitter, the "Don Jon" star politely denied Donald Trump's $70,000 tax break plan.

"So Donald Trump wants to give me $70,000 in tax cuts per year, and by the way, he doesn't want to give that to everybody," the actor began. "But I just read that's the average tax break for the top 1% if Donald Trump is elected president: $70,000 ."

"Well, you might say he's gonna give tax breaks to everybody, but not really 'cause of all the tax cuts, of all that money, nearly half of it is gonna go to just the top 5% of people," he continued.

Joseph Gordon-Levitt Denies Donald Trump's $70K Tax Break

The 43-year-old went on to talk about who he believes will help Americans and why he doesn't think Donald Trump is that guy.

"Now, do I need an extra $70,000? Honestly no, my family and I are doing fine," he said. "Do I deserve an extra $70,000? I don't think so. It doesn't feel right to me. Especially when he's also talking about cutting programs that help most people in our country."

"If you want to talk about whose really going to help most Americans, it's Kamala," he said, endorsing the current Vice President. "Trump's gonna help the same people he always tries to help, the wealthy. Himself. He was born a wealthy guy."

"And look, I completely respect needing to vote for the candidate that's gonna make it easier for your family, but Donald Trump isn't that candidate," Gordon-Levitt told his followers. "Donald Trump's trying to give me $70,000, so Mr. Trump, thank you, but no thanks."

The Penn Wharton Budget Model Speaks Out

The Penn Wharton Budget Model's analysis shows that under Trump's proposed plan, individuals earning $81,415 per year would receive a tax break of $1,740, whereas those with an annual income of $19,595 would only receive a $320 tax break.

"It's true that Trump looks like he's a winner for everybody, but he'll provide much bigger giveaways to the top 1% and top 0.1%, whereas Harris will be negative for these people," Kent Smetters, faculty director of the Wharton program, told CBS News Friday.

How Do Trump's And Harris' Tax Proposals Differ?

These two proposals represent contrasting approaches to supporting U.S. families and promoting economic growth. Trump's plan offers tax cuts across all income groups, with the most significant benefits going to higher-income Americans.

In contrast, Harris' plan focuses on providing the most considerable advantages to lower-income households while increasing taxes for the wealthiest Americans.

Ultimately, both plans would result in substantial costs, but the Penn Wharton Budget Model forecasts that Trump's combination of tax cuts for corporations and individuals would be more expensive.

"Donald Trump's campaign may want to mute Donald Trump on the debate stage, but they can't mute our strong economy and Trump's disastrous agenda that will explode the deficit, increase costs on the middle class by nearly $4,000 a year, and send our economy hurtling into a recession by mid-next year," Harris-Walz spokesman James Singer told CBS in an email.

2024 Presidential Debate

ABC News intends to mute candidates' microphones during next month's 2024 Presidential Debate between Donald Trump and Kamala Harris, according to rules obtained by Axios. However, Vice President Harris' campaign has not yet agreed to these terms.

Alongside the microphone policy, ABC News plans to conduct the debate without a live audience or opening statements.

Additionally, candidates will be prohibited from bringing props or pre-written notes onto the stage.

The 2024 Presidential debate is set for September 10.