Sarah Michelle Gellar Talks Money: 'It Can’t Be Taboo, We're Crippling Our Children'

By Melanie VanDerveer on October 25, 2023 at 1:00 PM EDT

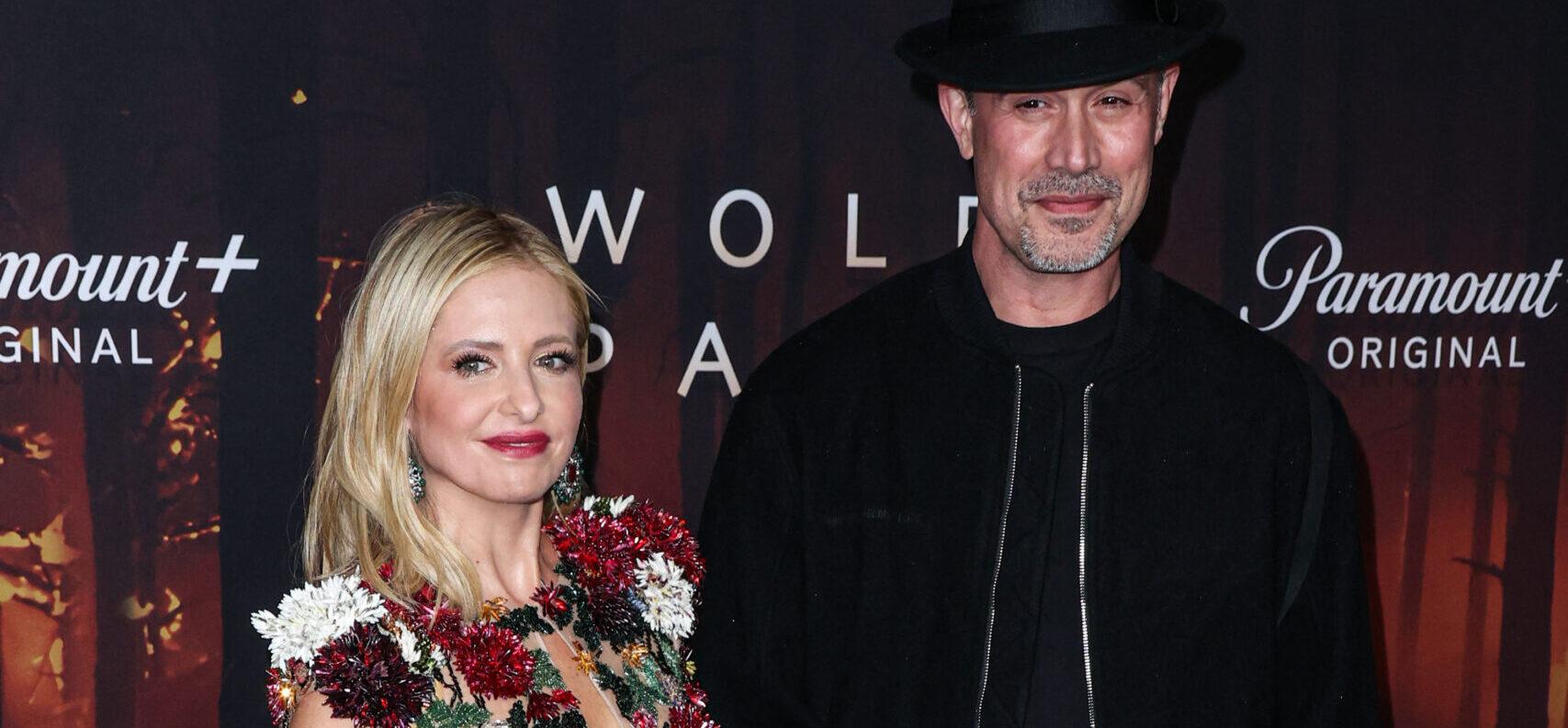

Actress, producer, businesswoman and mom of two, Sarah Michelle Gellar understands the importance of teaching the younger generation about financial literacy.

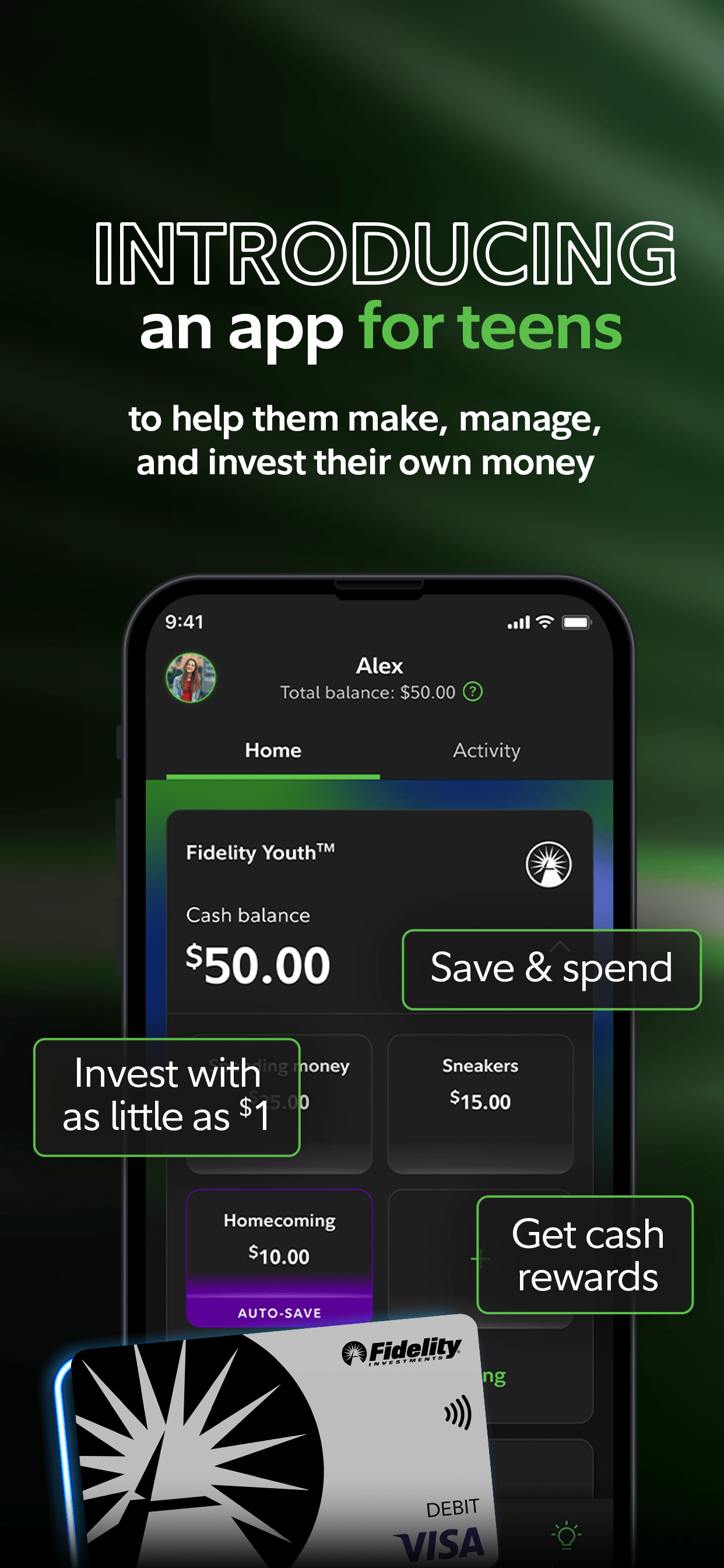

She recently partnered with Fidelity to share how their new app, Fidelity Youth, can help teens make, manage and invest their own money while teaching them valuable skills that they’ll take with them to every stage of life.

Sarah Michelle Gellar Partnered With Fidelity To Help Kids Learn Financial Literacy

For the actress, talking about money with her kids at an early age was something she always felt was important. And after her teenage daughter recently went to her asking for a credit card, she realized that times are changing.

“It’s an important subject to talk about,” Gellar told The Blast exclusively. “My daughter came to me and said, ‘You know, mom, I really need a credit card,’ and I said, ‘Yeah, no way.’”

But then her daughter told her that so many places are no longer accepting cash and that’s when Gellar realized “this isn’t my childhood anymore.”

“Things are different, and I need to go in the way that she learns and so I had to sit down as a parent and really start to do the research and figure out what the best way to teach her financial literacy really was,” she continued. “And especially when you really sit down and think about it, because there’s no transaction of actual money anymore, it makes it much more in the ether.”

Gellar said she thinks that most children don’t fully understand earning and saving money, because they’re not seeing it in the same way as past generations did.

“When we had a piggy bank and you had this much money and then it dwindled, it’s so much more figurative now and I think that literacy component is so much more important,” she said. “I actually came across the Fidelity Youth app initially before they even contacted me because I was already doing this research.”

The Fidelity Youth app “speaks to the kids” in a language they understand, and that’s just one of the reasons Gellar loves it. With parenting tools that help parents oversee without making decisions, she said it’s so simple with no account fees or minimums, and a great way for kids to learn financial literacy.

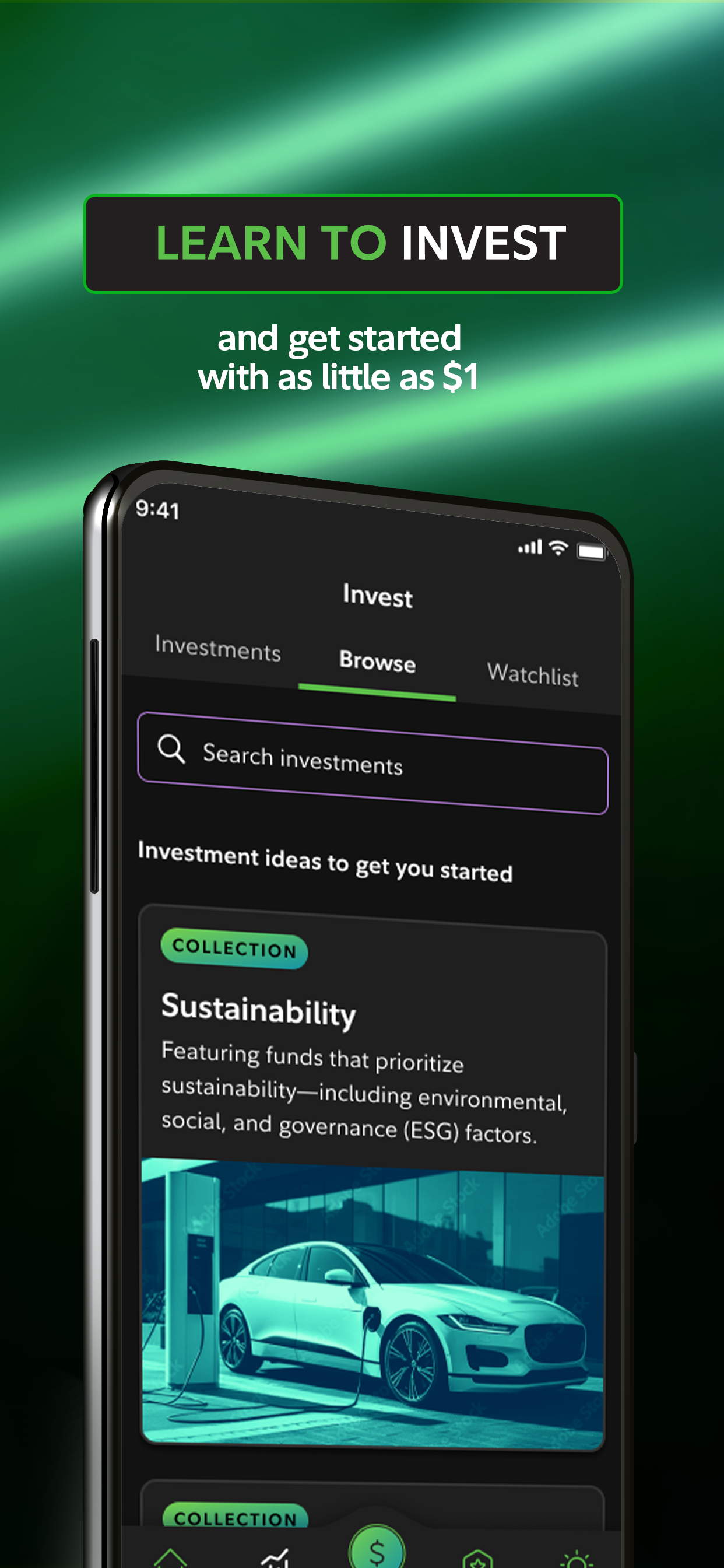

“You can really start with a small amount so the kids can really learn. And then they make it fun for the kids to continue learning because sometimes you get them a credit card and that’s it and you put money on it and again, they don’t understand where the money comes from,” Gellar told The Blast. “But with Fidelity, they have these learning courses the kids can do, and the kids can earn money from that and they can learn investing. It really is a safe environment that has a lot of parental over see.”

Sarah Michelle Gellar Started To Teach Her Kids About Money At An Early Age

For Gellar and her family, money was a topic of discussion since the kids were young. She started off with three jars, one for spending, one for saving and one for donating, for when the kids got birthday money.

“I really gave this a lot of thought and I think it’s so hard because kids think everything just comes from a machine,” she said. “You need cash, you go to the cash machine. But they’re not really understanding that we have to work, that we have to earn the money, that there’s taxes, that there’s ways to make money on your money. And those aren’t easy conversations to have.”

The app helps to have those money conversations without talking about “my money.” That helps to make it become “their conversation” instead.

Gellar began with the three jars when her kids were around the age of 5, and it’s paved the way for more money conversations as the kids grew up.

“So, when they got birthday money, they understood that, and in that conversation we could also talk about you get to have a save and this but we have to give money to the government. We really do try to have those conversations,” she said. “It can’t be taboo anymore because we are crippling our children.”

Gellar shared a story about when one of her friends went off to college and got a credit card. She said she used her card for everything and ran up a lot of debt. Her parents helped her out and paid it off, but then she did it again and that time, her parents told her they weren’t bailing her out a second time.

“And she’s like, ‘What do you mean?’ Because they never had those conversations,” she said. “It was a credit card, you charge stuff on it, but she didn’t have any understanding that that was her parents’ money that she was earning, that they were earning. And I think these are the conversations to have.”

One thing that Gellar was surprised to learn was the fact that parents are less likely to discuss money with their daughters.

“Some of the studies are really amazing to me,” she continued. “Parents are less likely to talk to girls about financial literacy than they are to boys. Which, again, just perpetuates that myth of, ‘Oh, men will take care of us,’ well that’s not how the real world works," she said. "The earlier the conversations, the less challenging they get. You meet them where they are.”

The “Buffy the Vampire Slayer” actress bought her first house at the age of 20 and said that was her first introduction to owning something big. She worries about the younger generation because they seem to be moving further and further away from becoming homeowners.

“It's a lot of renting, and while I do see great things about renting, also, at the end of the day, you’re just paying someone else’s mortgage,” she said. “Yes, houses can also be an investment but it’s also an investment in you. There’s really something self-satisfying about owning a home.”

The Fidelity Youth app is the industry’s first retail brokerage account with saving, spending and investing for teens ages 13 to 17. It’s user friendly and offers enhanced features to help teens put their financial learning into practice.

Through the app, teens can learn through videos, articles and tools, organize their funds by category such as saving and spending, invest by purchasing mutual funds, stocks and EFTs, and earn money by taking actions in the app, completing learning modules and referring friends to the app.